OeEB finances private sector investment projects in developing countries and emerging markets. We offer tailored solutions at near-market conditions with long terms for projects that are developmentally and economically sensible.

Tailored solutions for long-term investments.

The securing of the loans with a state guarantee from the Austrian Federal Ministry of Finance means that we can take more risks than commercial banks and offer longer terms for loans. In contrast to commercial banks, we only offer financing for projects in developing countries and emerging markets, and thus only outside of the EU. Loans are granted at near-market conditions that are based on the country and project risks.

We grant:

- long-term loans and risk sub-participations

- refinancing lines for financial institutions with a specific loan purpose (e.g. financing of small hydroelectric power plants, projects of small and medium-sized enterprises or projects in the energy efficiency sector)

All projects financed by us make developmental and economic sense.

- Financing share OeEB: up to approx. EUR 25 million per transaction

- Equity capital shares: at least 30% of total project volume

- Term: depending on the project, up to 15 year repayment period (incl. interest-only periods)

- Conditions: near-market (without interest relief) in EUR or USD

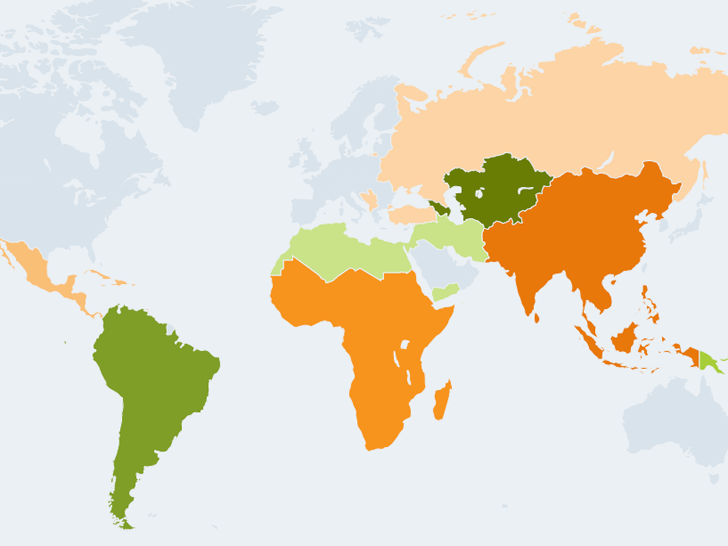

We can finance projects in all developing countries and emerging markets pursuant to the OECD Development Assistance Committee List (DAC list).

According to The European Development Finance Institution (EDFI) "Principles for Responsible Financing", we do not finance projects in any sector listed on the following Harmonized EDFI Exclusion List.

Send us your project proposal

You are looking for a financing partner for your project? Tell us about your project idea.