OeEB was founded in March 2008 as the development bank of the Republic of Austria. With a public mandate we work for better living conditions in developing countries.

We create better living conditions through a vibrant economy.

We are a wholly-owned subsidiary of Oesterreichische Kontrollbank (OeKB). As a private stock company with a public mandate, we provide financing at near-market conditions, but we can take on more economic risk than commercial banks. We acquire a financial interest in companies in developing countries and emerging markets and strengthen the developmental effects with collateral measures, our Business Advisory Services.

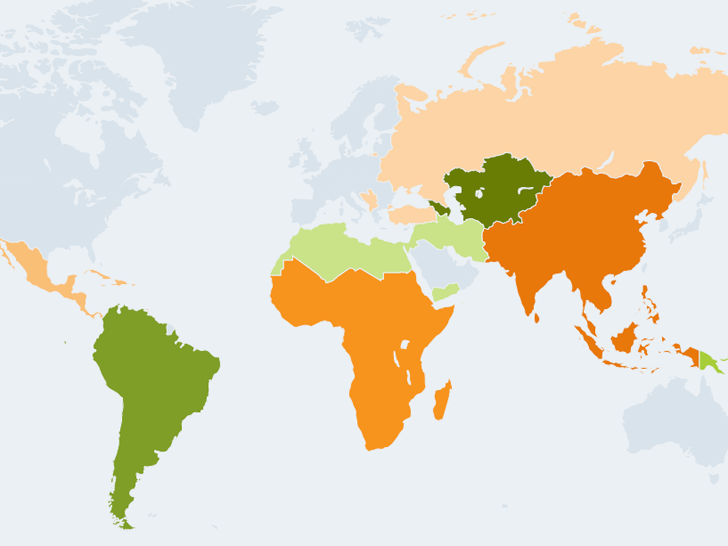

We are present in markets in developing countries and emerging markets in which companies often have no access to urgently needed capital, both credit and equity. Investments in these projects create jobs; these projects increase tax revenues and bring foreign currency into the country.

Principle of additionalityPrinciple of additionality

In all our financing projects, we must ensure that we act complementarily and synergistically to national and foreign commercial banks and that it in no way ousts private actors due to subsidies (principle of additionality). We distinguish between 'financial additionality' (i.e. financing is provided which is not available on the market due to the longer terms which are required or the greater level of risk) and 'value additionality' (i.e. by linking the financing with the introduction of new or improved environmental and social standards, governance criteria, risk guidelines etc. at the client).

In light of the updated OECD guidelines in the context of the reporting on Private Sector Instrument, OeEB further applies and reports on the "development additionality" of its projects. This refers and documents the intention of each project to "deliver development impact that would not have occurred without the partnership between the official and the private sector."

In accordance with the OECD regulations, additionality can be proved by demonstrating the financial or value additionality of a project, together with its development additionality.

Our Mandate

As the development bank of Austria, we act with a mandate from the federal government and are committed to the objectives of the Austrian Development Cooperation. We finance and support projects in developing countries and emerging markets that are economically sustainable and have positive impacts on development.

We finance sustainable development.

It is our mandate to provide stimulus for sustainable economic growth in order to improve the living conditions of people in disadvantaged regions over the long term. In doing so, we are careful to adhere to international labour, environmental and social standards.

We finance projects that comply with the criteria for developmental policies. They

- contribute to the creation of jobs and national income,

- improve access to modern infrastructure and to financing,

- support the supply of energy (in particular through renewable energy projects and energy efficiency projects).

We invest in promising business engagement.

We strengthen Austria's relationship with those countries that want to take advantage of private sector involvement in order to make long-term improvements to their living conditions. Our offerings supplement and support the work that Austria's politicians, investors, banks and citizens do for development in the poorer countries of the world.

OeEB - Member of EDFI

Since its foundation in 2008, OeEB has been a member of the European Development Finance Institutions (EDFI). EDFI was founded in 1992 and is an association of 15 European financing organizations that are active in developing and emerging countries. These were commissioned by their respective governments to promote growth in sustainable businesses, to help reduce poverty and improve living conditions, and to support the achievement of the Sustainable Development Goals (SDGs). This is to be achieved by promoting economically, ecologically and socially sustainable development through financing and investments in profitable private sector companies.

In addition to helping members achieve their vision, EDFI serves to educate the public and government stakeholders about their role and contribution to development.

In 2022, the overall EDFI portfolio comprised around 53 billion euros in more than 6,900 projects. OeEB is the seventh largest development bank among the 15 members in terms of portfolio.

Code of Conduct

OeEB's success is based on its high reputation and the trust our clients and stakeholders put in us. This is determined by the high standards we apply to our work when we tend to our clients' needs and deliver our services.

MoreThe Code of Conduct of OeKB bank group, which OeEB is part of, describes our basic values and standards for ethical business conduct. It is intended to serve as a guideline for us in our day-to-day business and in our dealings with internal and external stakeholders, supporting independent action and promoting an open, respectful and responsible working atmosphere.

Legal Basis

The legislative basis for our business activities is defined primarily in the scope of the Austrian Export Guarantees Act - in German "Ausfuhrförderungsgesetz".

MoreThe official legislative texts can be found in the Austrian Federal Law Gazette or online in the Legal Information System of the Republic of Austria (RIS).

Rating

On 27 June 2025, Standard & Poor's Ratings Services confirmed its 'AA+' long-term and 'A-1+' short-term issuer credit ratings for Oesterreichische Entwicklungsbank AG. The rating corresponds to the rating of the Republic of Austria.

MoreAccording to Standard & Poor's this rating reflects Oesterreichische Entwicklungsbank's critical role in implementing Austria's international development policy, since it is the government's sole agent for financing private-sector investments in developing and transition countries. Furthermore, OeEB's connection to Oesterreichische Kontrollbank AG (OeKB) had a positive effect on the rating of OeEB.