As an impact investor, all of OeEB's investments are made with the intent to generate measurable and sustainable development impact in developing and emerging countries. In doing so, we work in accordance with the "Operating Principles for Impact Management".

The Operating Principles for Impact Management were developed under the lead of the International Finance Corporation (IFC) and launched on April 12, 2019. They provide a common market standard for what constitutes an impact investment and offer investors a framework for the design and implementation of their impact management systems.

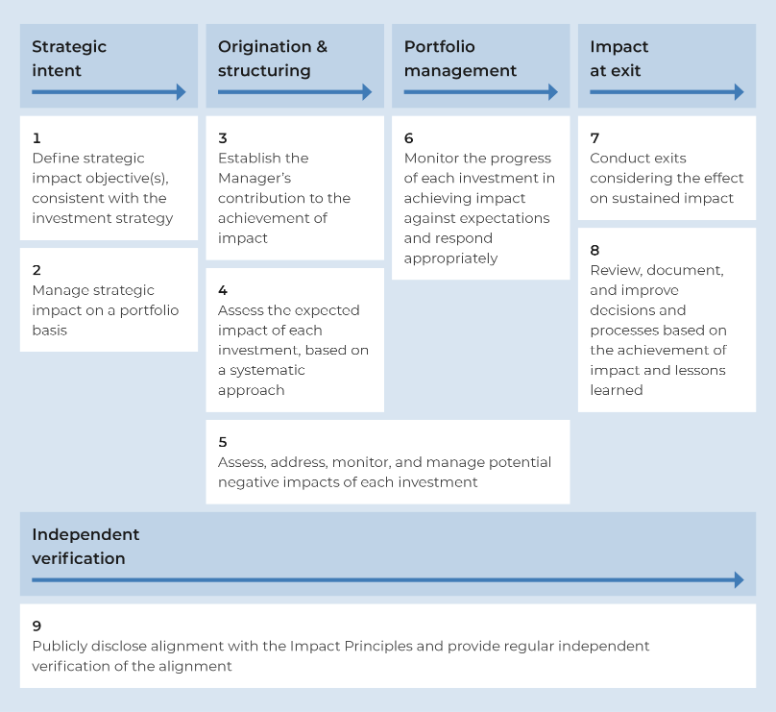

By becoming a signatory, investors commit to manage their impact assets in accordance with the Impact Principles. The Impact Principles ensure that impact considerations are integrated into all phases of the investment lifecycle: from creating the investment strategy to identifying and structuring investments to portfolio management and exit.

OeEB among first adopters

OeEB was among the founding signatories of the Impact Principles. As an impact investor, we intend to create measurable and sustainable development impact in developing and emerging countries through all of our investments. The projects we finance contribute to creating jobs and national income and help improve access to finance, clean energy and modern infrastructure.

In our disclosure statement we describe how we have incorporated the Impact Principles into our investment process and confirm that our total portfolio of loans and equity participations - 1,743.2 million as of December 31, 2024 - is managed in accordance with the Impact Principles. An independent verification report confirms that our impact management system complies with the Impact Principles.